January 2018 Shipment Report

Shipments for January were up significantly over both December and January of 2017, landing back above the 1,600 mark with 1,618 homes. Manufacturers shipped an additional 371 single-section homes over January of 2017 and 78 more multi-section homes.

The Harvey recovery effort continues with the government reporting that 2,934 households are still in need of direct housing. The demand for temporary housing, the private permanent rebuilding effort, and the supply constraints on in-state manufacturers kept shipments into the state from plants outside of Texas elevated at 160 homes. The average for shipments into the state prior to the Harvey recovery in 2017 was 58 homes.

The permanent rebuild effort funded by a $5 billion grant from HUD to the Texas General Land Office is still making its way through the process. The GLO is finalizing its action plan which will be released for public comment. After that, the GLO will submit its public comments response to HUD before the agency starts moving funds into projects.

As we continue into 2018 there are a number of additional market forces that will be pushing up the demand for MH in the state, I’ve included an overview of those other major storylines below this months data.

January

| Shipments | Singles | Multis | Total |

|---|---|---|---|

| Total for January: | 1,057 | 561 | 1,618 |

| Change from December: | 37.63% | 13.33% | 28.11% |

| Change from January of 2017: | 54.08% | 16.15% | 38.41% |

| Total for 2018 YTD: | 1,057 | 561 | 1,618 |

| Change from 2017 (%): | 54.08% | 16.15% | 38.41% |

| Change from 2017 (Units): | 371 | 78 | 449 |

Shipments and New Titles Monthly

Trends and Forces for 2018

The following is an outline of some of the major factors I expect to play a key role in the markets this year.

Taxes

Every year we see the March spike as consumers use those tax returns as down payments on new homes. Texas is second in the nation for average tax return amount from 2017, and that is to say nothing of the effects of the new tax law for 2018. Support for the new tax law continues to grow as workers take home pay increased last month, and with more cash on hand and with better expectations about their financial future, more major investments like new home purchases should certainly follow.

Businesses will also be utilizing the additional funds they will have on hand as a result of the lowered corporate rate and the 20-percent pass through deduction. That additional capital will go to increased investment in productivity, additional business locations, and new product innovations.

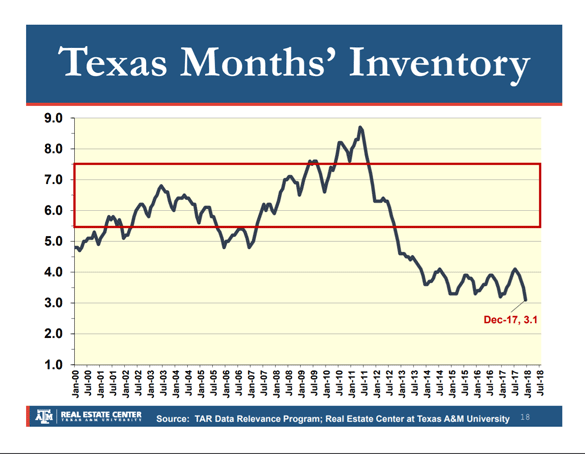

Housing Supply and the Economy, Stupid

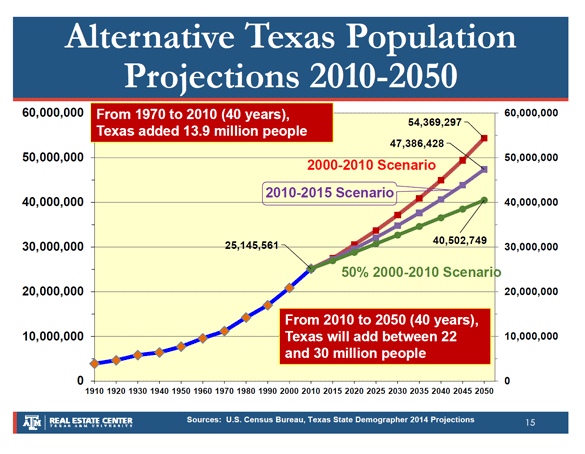

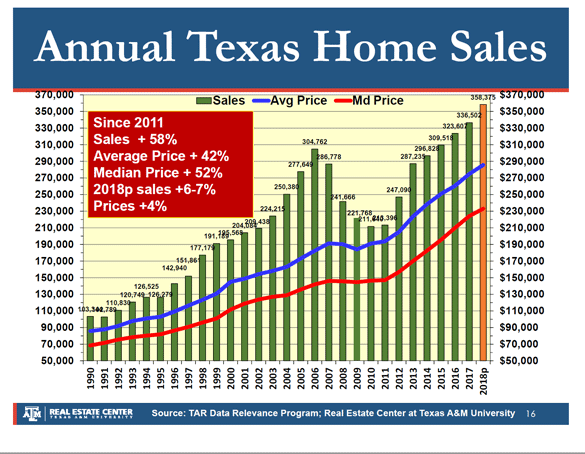

The current economic conditions for Texas and the state of the housing market are another major part of the 2017 and 2018 story for MH sales. I had the privilege of attending the Finding Shelter conference sponsored by the Federal Reserve Bank of Dallas and the Real Estate Center at Texas A&M University in Dallas last month, and I can think of no better way to illustrate the potential market energy for MH that exists today than to share with you some of the key slides from some of the best real estate economists in the state.

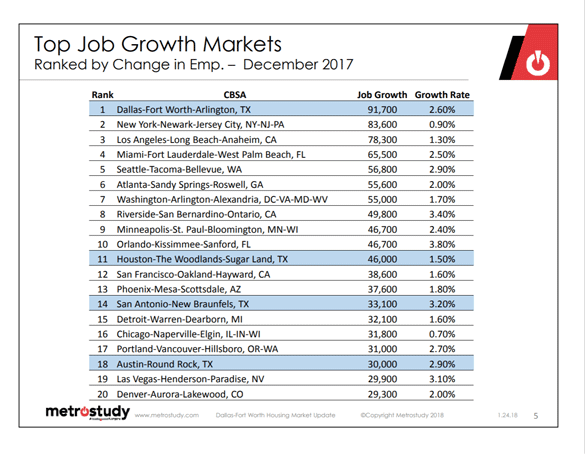

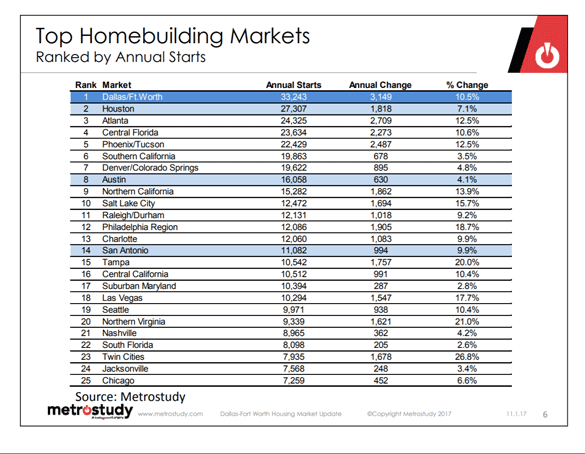

The Texas Miracle Continues

Recognize any of the core-based statistical areas below? (Hint: They’re highlighted in blue.)

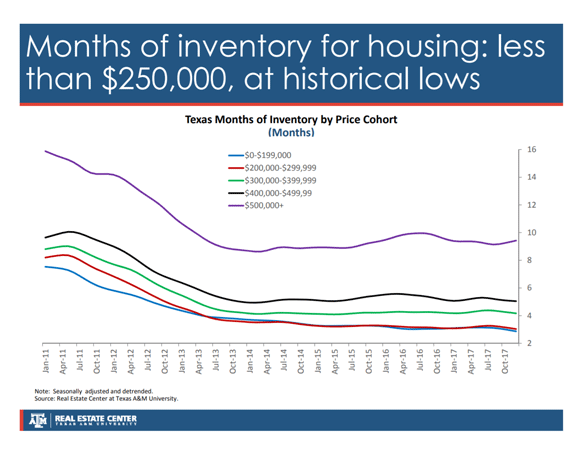

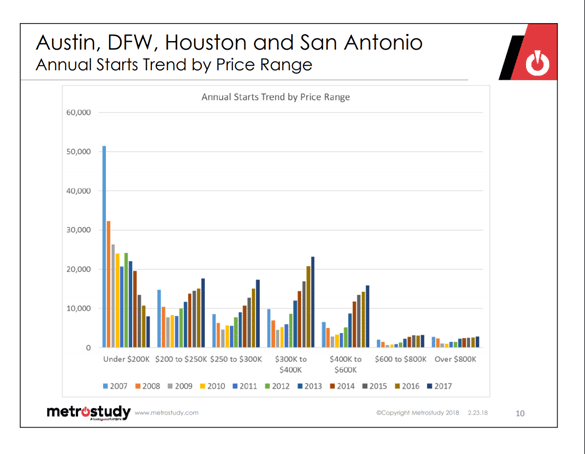

But New Affordable Homes are not being Built in Mass

In 2007 new homes under $200K were the bread and butter for major metro starts, from that height they have fallen off a cliff.

Where Does that Leave MH?

With the state experiencing a shortage in affordable housing all available housing options with monthly payments that fit within a household budget are going to see increased demand, and any construction process that can lower costs, speed up construction time, and deliver quality homes is uniquely positioned to help alleviate the supply constraint.

Hmmm... that sounds like an industry we know something about.

The MH industry is not without its own challenges for 2018, costs of construction materials, costs and availability of labor, and regulatory hurdles (most specifically zoning) all come to mind. But despite these headwinds, markets are efficient, and Texas households should continue to show why MH is a perfect fit for families looking to purchase quality affordable homes.