Texas Manufactured Home Shipments Report January 2026 - Market Analysis & Data

Rob Ripperda

January Shipments

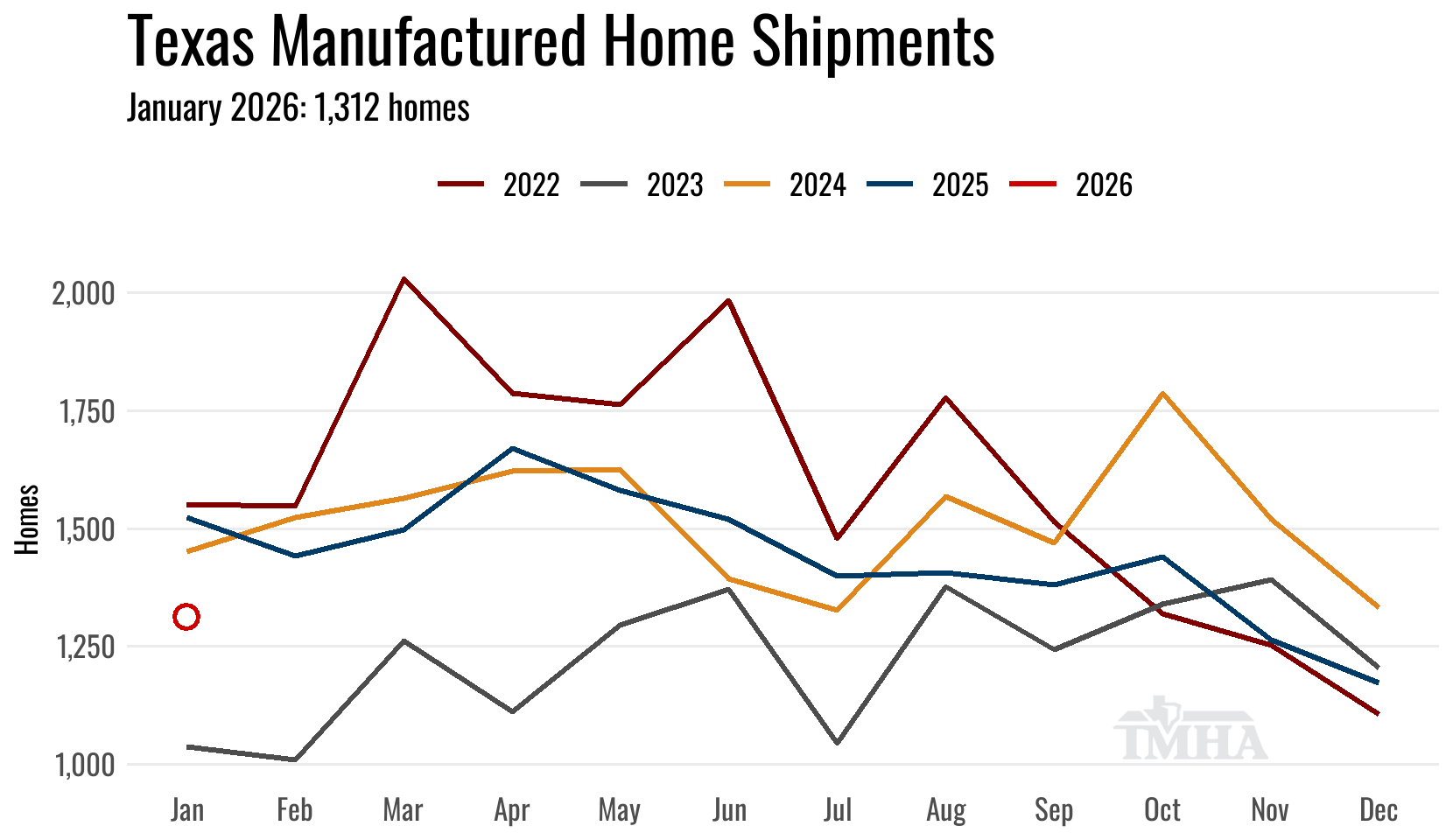

Manufactured home shipments to Texas retailers moved up 4.6% in January on a seasonally-adjusted basis from the prior month. Year over year, shipments were 13.9% below January of 2025.

The shipment total was well above the 2023 January low, but came in under the 1,500 mark where most recent years have clustered.

The 1,312 total homes shipped for the month landed in the lower side of the prediction interval at 65 homes below the point forecast from last month.

| Shipments | Singles | Multis | Total |

|---|---|---|---|

| Total for January: | 590 | 722 | 1,312 |

| Change from December (Raw %): | 23.9% | 3.6% | 11.8% |

| Change from December (Raw Units): | 114 | 25 | 139 |

| Change from December (SA %): | 15.3% | -3.4% | 4.6% |

| Change from January of 2025 (%): | -2.6% | -21.3% | -13.9% |

| Change from January of 2025 (Units): | -16 | -195 | -211 |

Monthly Manufacturer Shipments

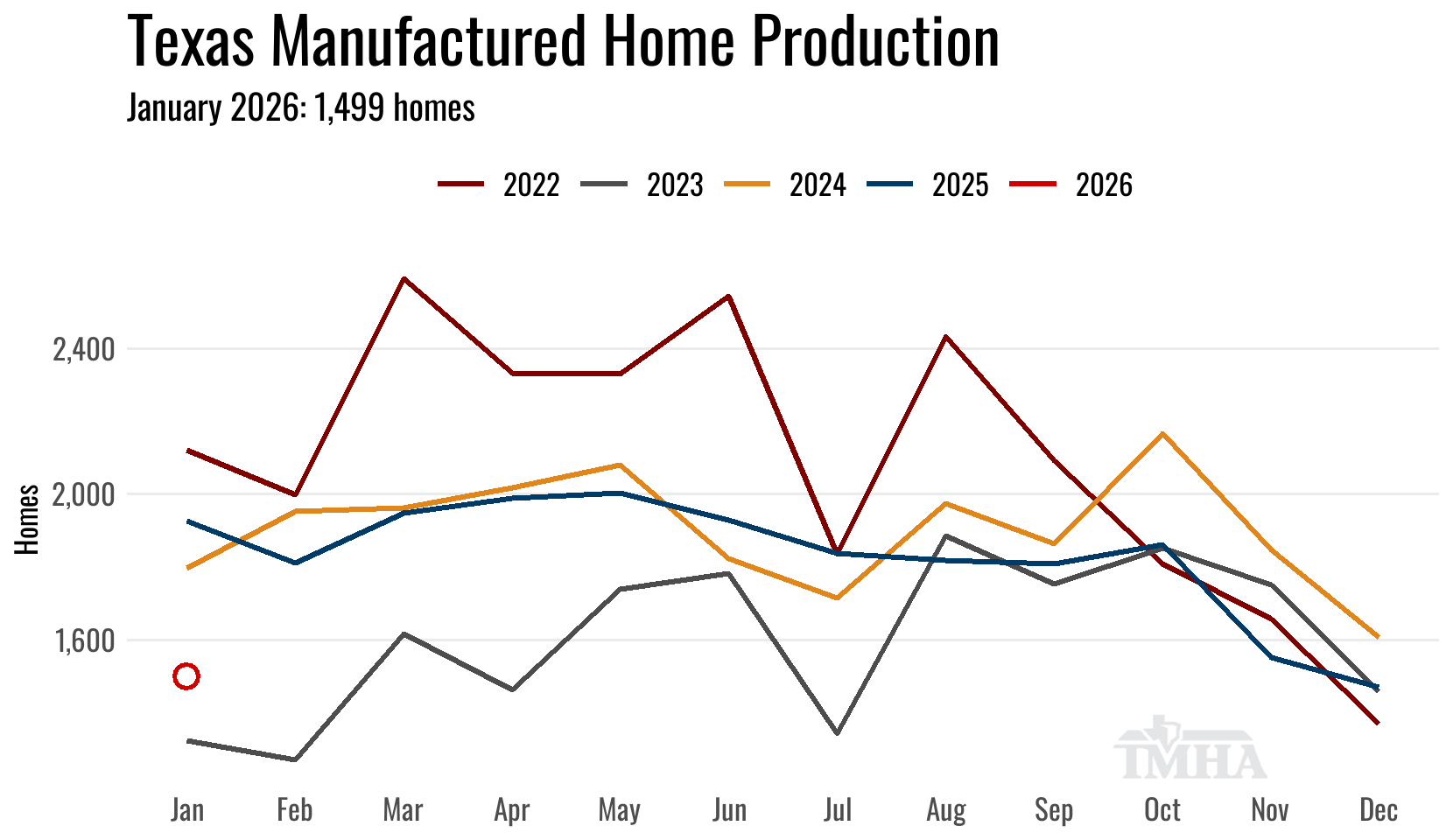

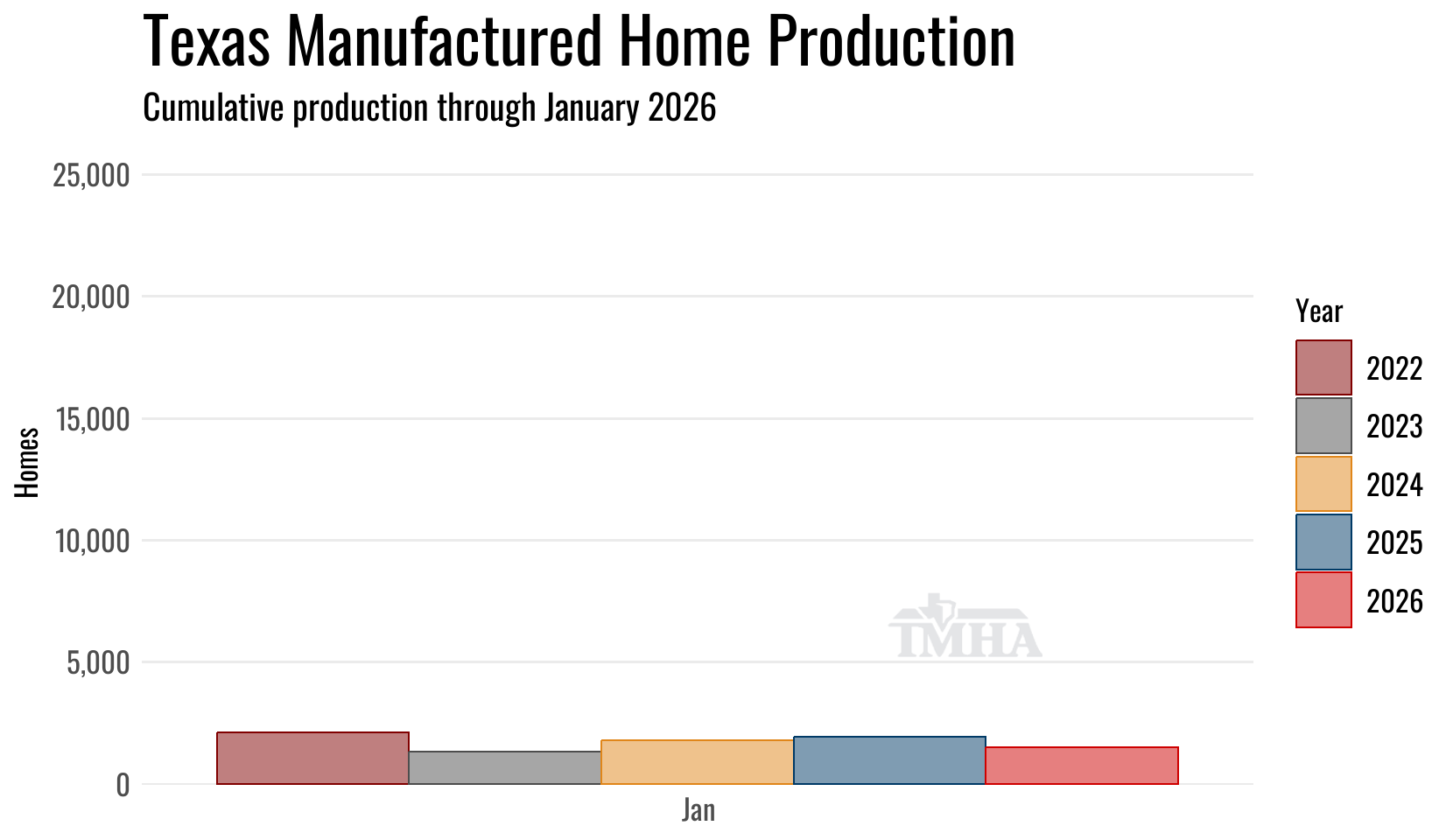

January Production

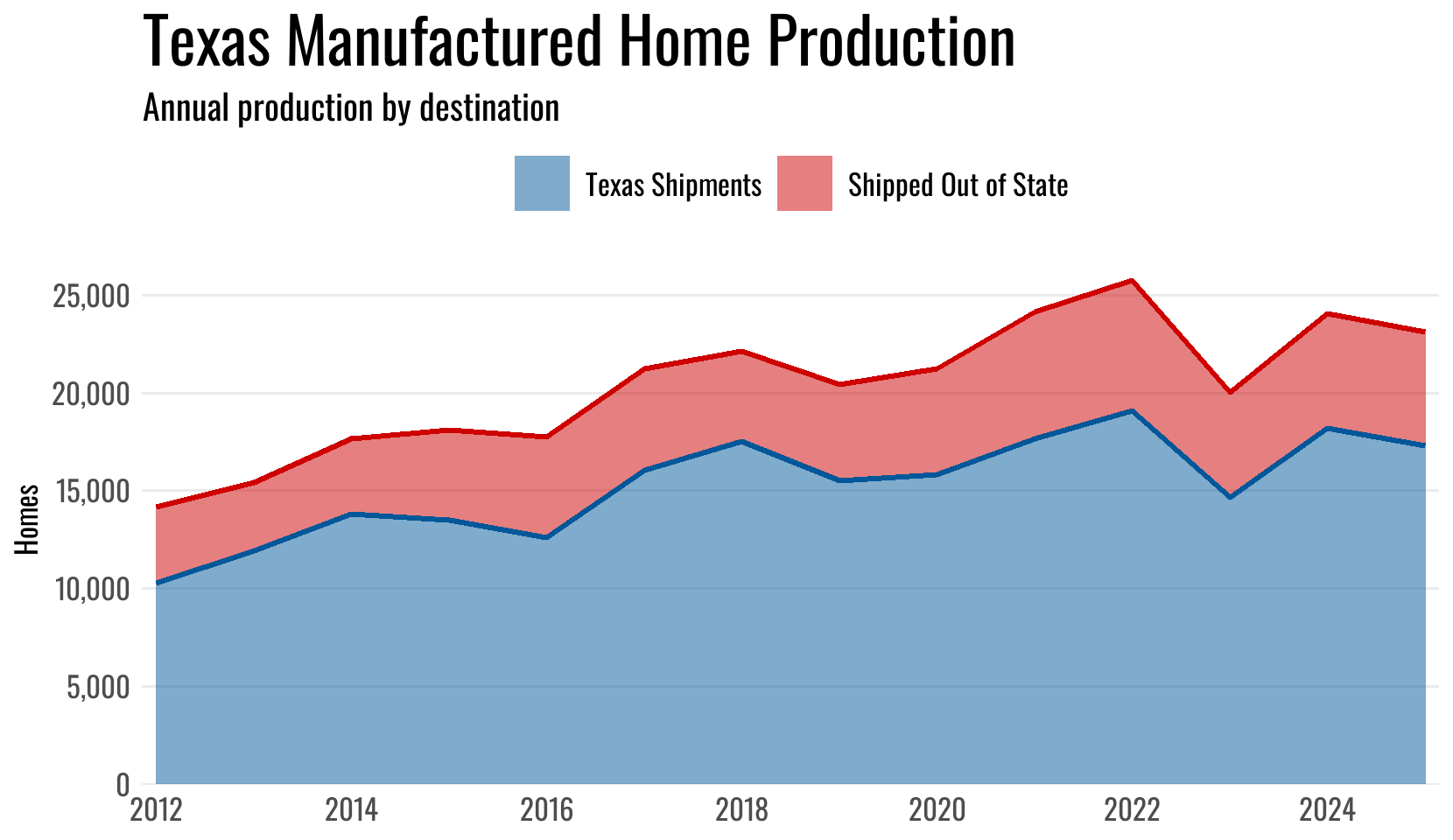

Texas manufactured housing plant production moved down in January 4.4% on a seasonally-adjusted basis from the previous month. The total of homes produced was 1,499 and minimum floors were 2,148.

Year over year, total homes were 22.2% below January of 2025, and minimum floors were 22.5% below.

The production total landed below the prediction interval, 240 homes under last month’s point forecast.

Overall production faired worse than shipments to Texas retailers which picked up a boost from homes coming into the state from out-of-state manufacturers. Production wasn’t as low as 2023, but it was closer to that total than to the last two years.

| Texas Plant Production | Total | Shipped Out of TX | Min Floors |

|---|---|---|---|

| Total for January: | 1,499 | 344 | 2,148 |

| Change from December (Raw %): | 2% | -0.9% | 1.3% |

| Change from December (Raw Units): | 30 | -3 | 27 |

| Change from December (SA %): | -4.4% | NA | -7% |

| Change from January of 2025 (%): | -22.2% | -32.7% | -22.5% |

| Change from January of 2025 (Units): | -428 | -167 | -622 |

Monthly Manufacturer Shipments

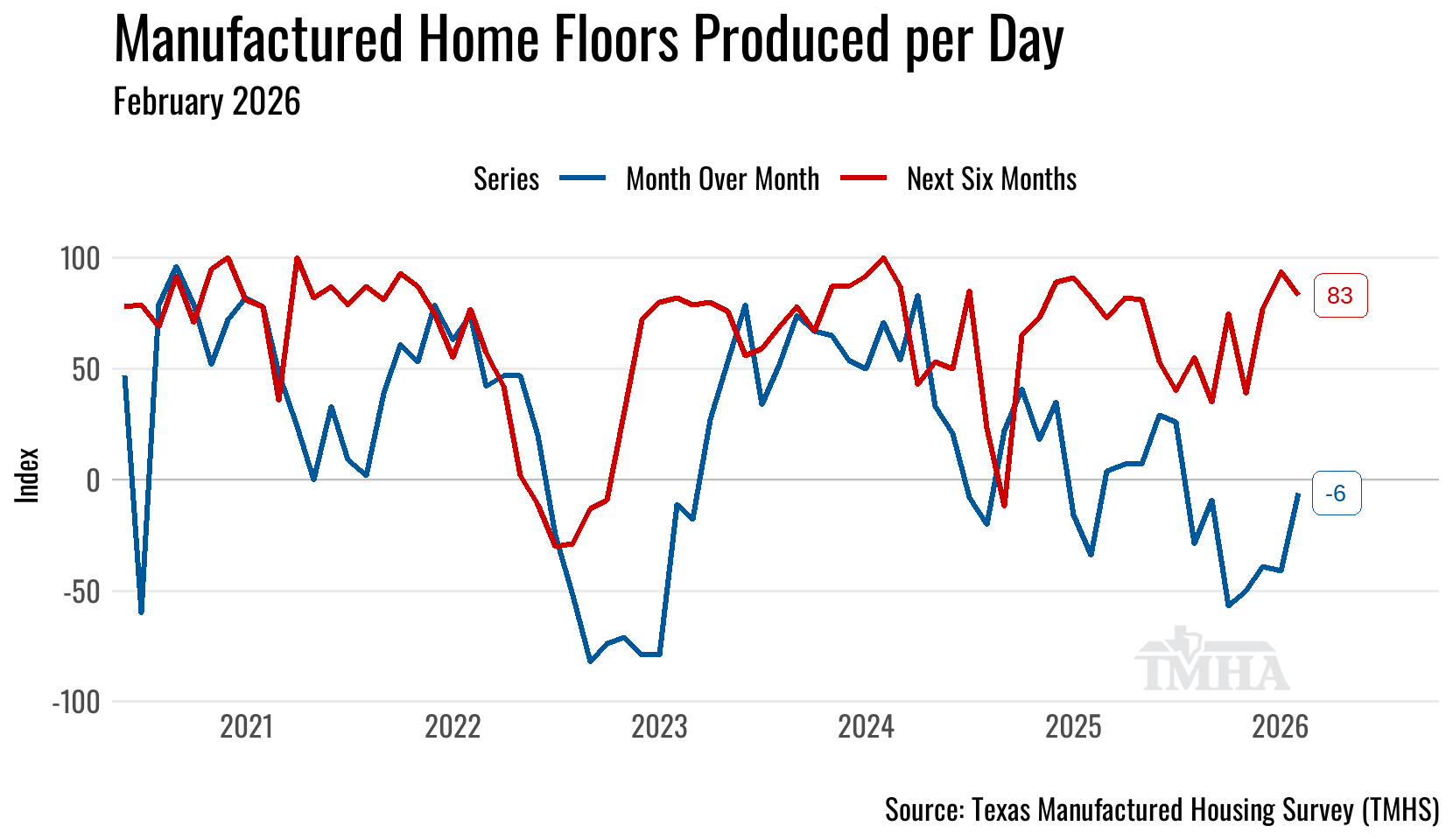

February Outlook

The forecasting models point to February shipments around 1,267 (1,070–1,464) and Texas factory production around 1,446 (1,223–1,670).

The Texas Manufactured Housing Survey (TMHS) signaled another month of lowered run rates in February.

Take the under on both point forecasts.

Texas Manufactured Home Survey Results

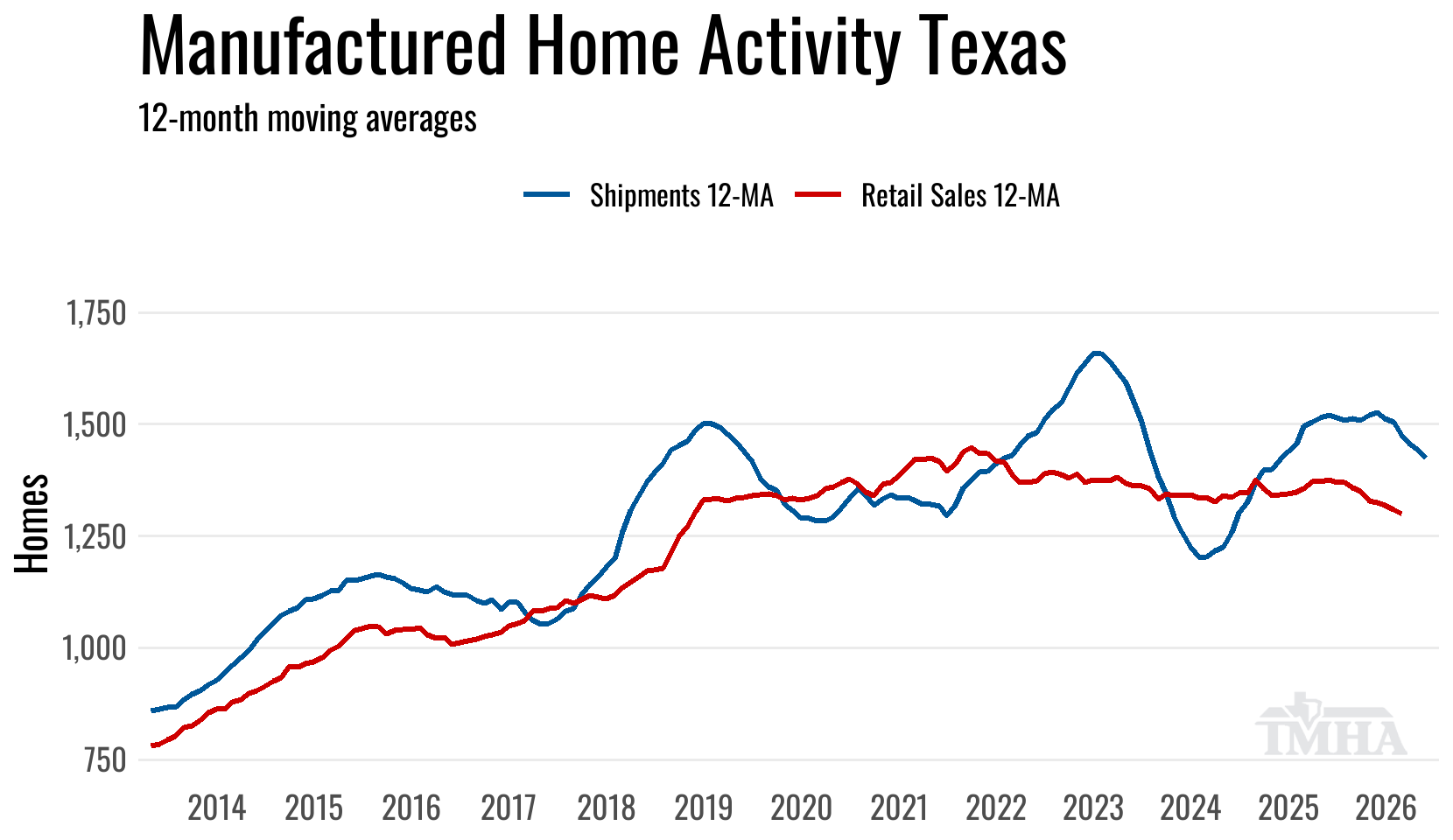

Retail Sales Comparison

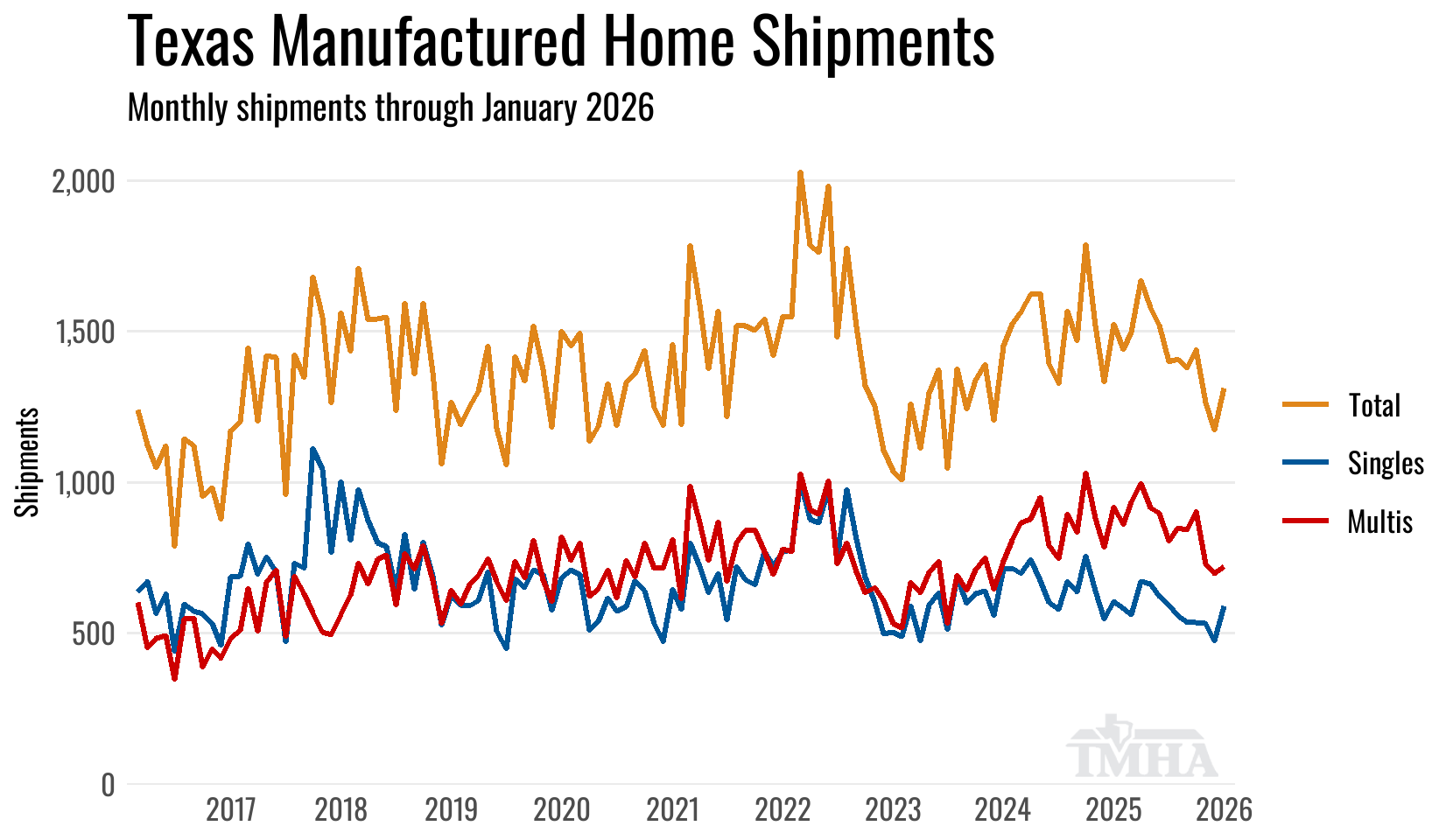

The 12-month moving average for shipments peaked in July 2025 for this production expansion cycle and has been moving lower through January 2026.

The 12-month moving average for retail sales is currently plotted through October 2025. Late title work will continue to push the most recent months higher, though not to the extent seen in prior years.

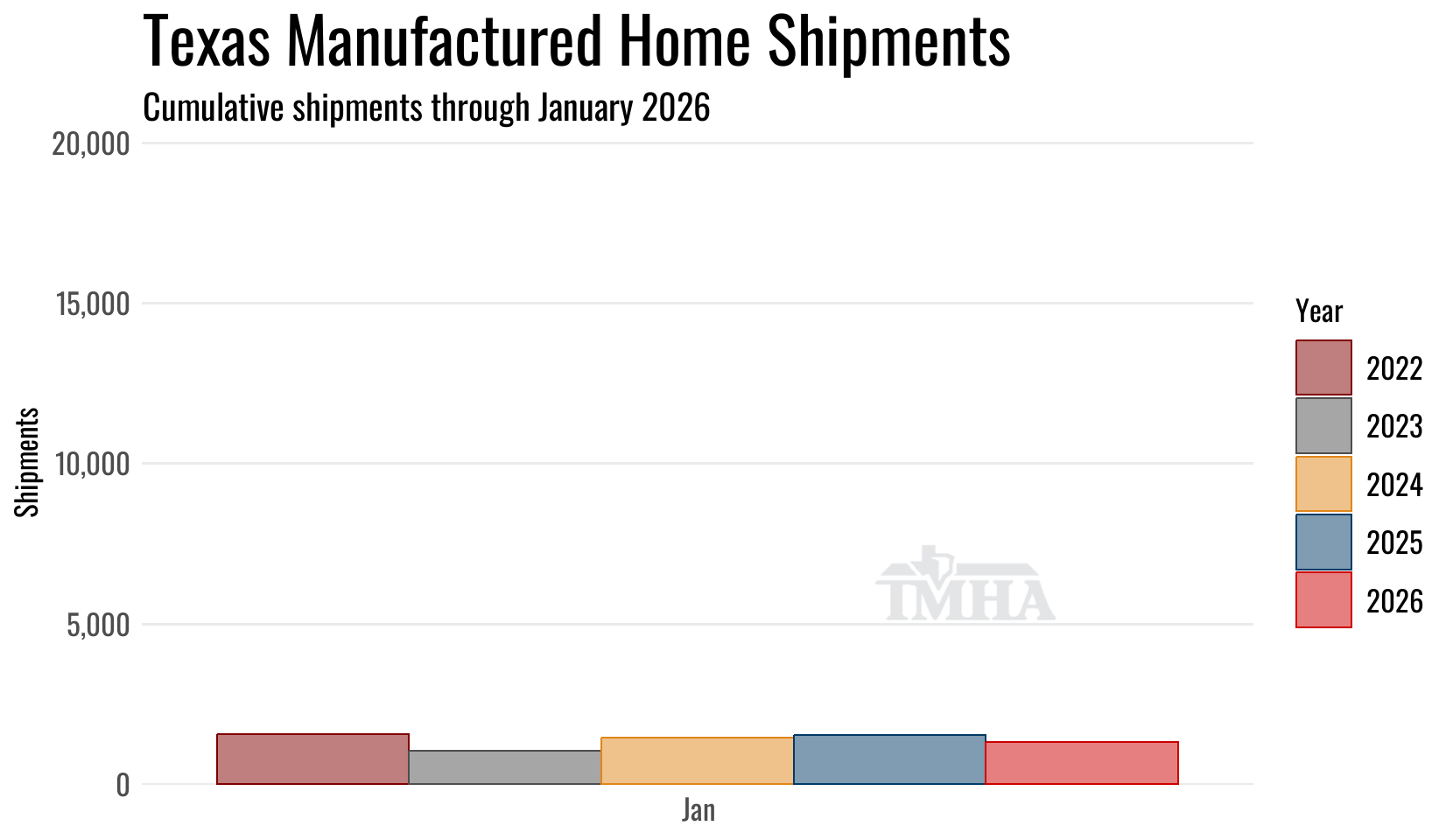

Year to Date

Shipments

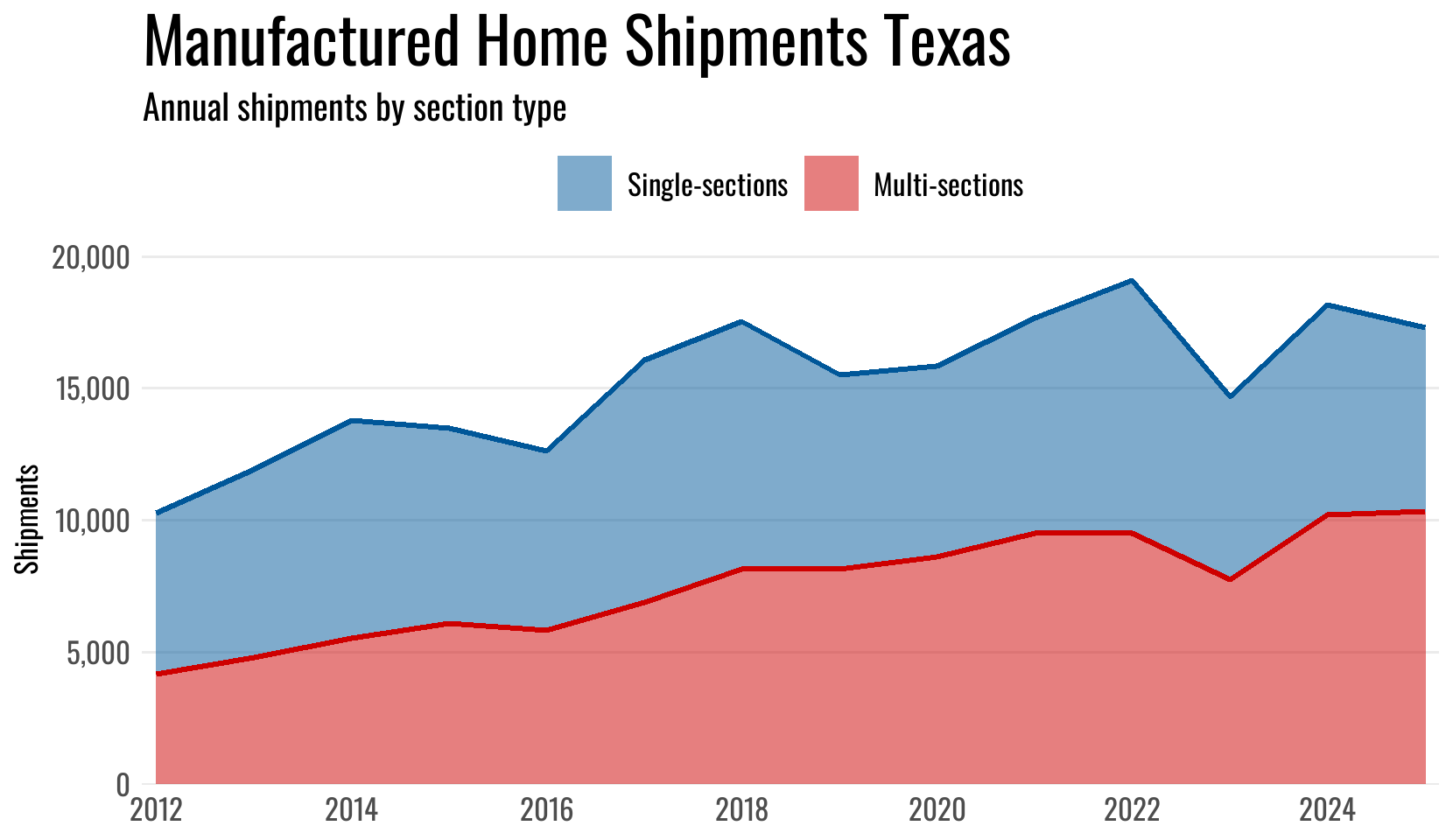

Shipments for the year started out 13.9% below 2025.

The forecast for 2026 Texas shipments moved down to 15,882 (13,071–19,196).

| Shipments | Singles | Multis | Total |

|---|---|---|---|

| Total for 2026 YTD: | 590 | 722 | 1,312 |

| Change from 2025 (%): | -2.6% | -21.3% | -13.9% |

| Change from 2025 (Units): | -16 | -195 | -211 |

Production

Texas plant total home production started 2026 22.2% below the previous year and the minimum floors built were 22.5% below 2025.

The forecast for 2026 Texas plant production moved down to 19,194 (16,017–22,744).

| Texas Plant Production | Total | Shipped Out of TX | Min Floors |

|---|---|---|---|

| Total for 2026 YTD: | 1,499 | 344 | 2,148 |

| Change from 2025 (%): | -22.2% | -32.7% | -22.5% |

| Change from 2025 (Units): | -428 | -167 | -622 |

Annual Totals