Texas Manufactured Housing Market Report December 2025 - Sales Data & Analysis

Rob Ripperda

December

Early Look

New manufactured home sales for December 2025 titled to date are up a seasonally-adjusted 7.2% from the previous month as the titling shift that has been underway since August continues to inflate the year-over-year numbers. Home sales that would have previously been titled with an earlier purchase contract date a year ago are now getting titled with a later date of when the change in ownership ultimately ocurrs.

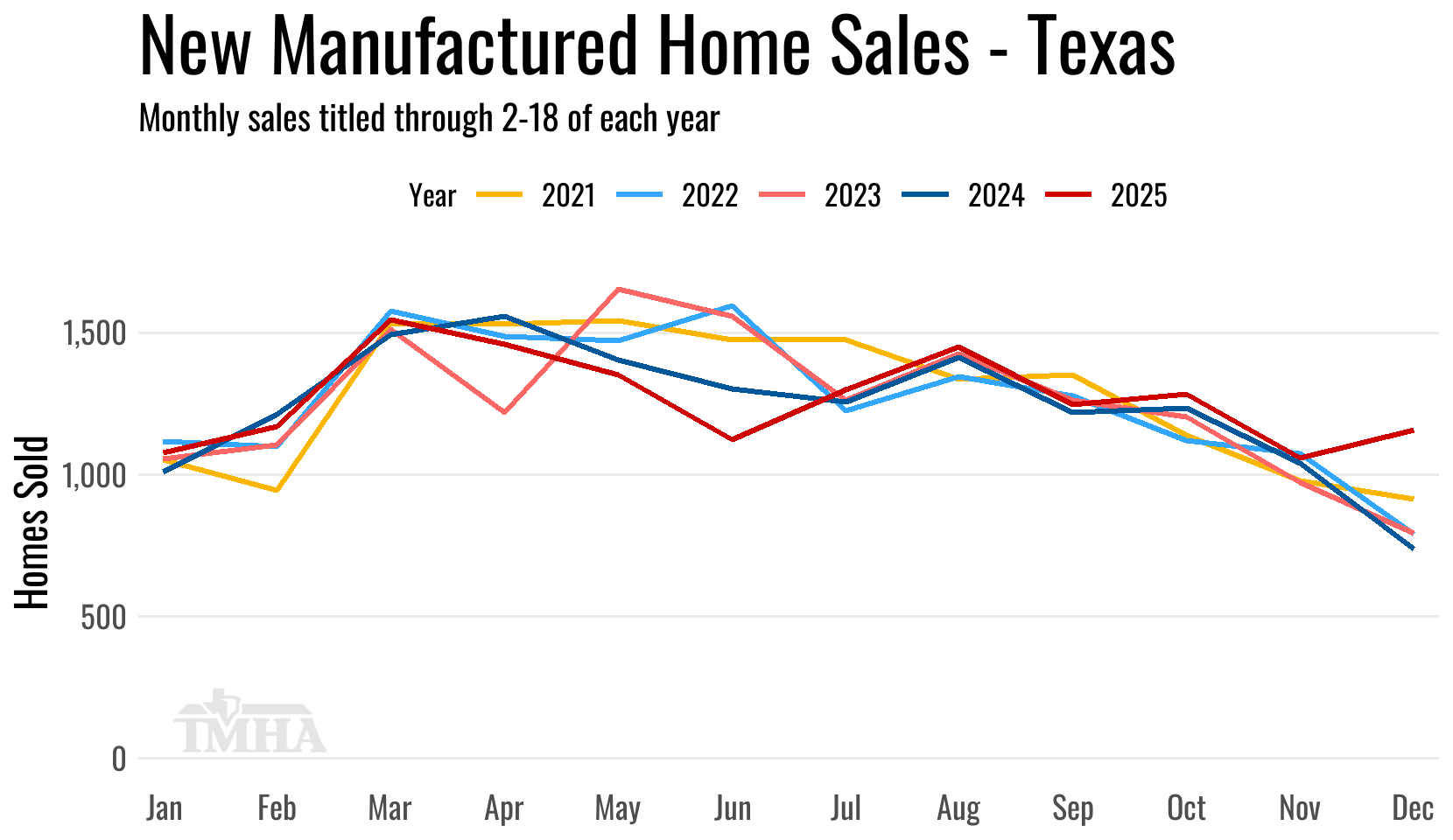

In the plot below you can see that from July forward the 2025 monthly sales totals are still ahead of 2024, but with the exception of December we expect that the 2024 sales totals should ultimately end above the 2025 totals. Those sort of additional sales that were ultimately realized for 2024 are pushing up the December 2025 total at present and will carry over into 2026.

Until we get through the summer of 2026, year-over-year numbers will remain high.

The comparisons in the table below are based on where the previous month’s numbers were when originally reported on one month ago.

| New Sales | Singles | Multis | Total |

|---|---|---|---|

| Total for December: | 467 | 675 | 1,142 |

| Change from November (Raw %): | 31.9% | 10.5% | 18.3% |

| Change from November (Raw Units): | 113 | 64 | 177 |

| Change from November (SA %): | 20.4% | 6.6% | 7.2% |

| Change from December of 2024 (%): | 51.1% | 65% | 59.1% |

| Change from December of 2024 (Units): | 158 | 266 | 424 |

THMA Member’s Retailer Annual Sales Totals Report

November

Titled on Time

New home sales for November titled to date were down a seasonally adjusted 0.3% from the previous month and are up just 2.9% on the raw total from November of 2024. As mentioned above, the November total for 2024 will ultimately finish above the 2025 total as purchase contracts that were signed for the month in 2024 were subsequently added in.

While the plot above contains revised totals for previous months the comparisons in the table below are based on where the previous month’s numbers were when released one month ago.

| New Sales | Singles | Multis | Total |

|---|---|---|---|

| Total for November: | 387 | 669 | 1,056 |

| Change from October (Raw %): | -19.9% | -13.5% | -15.9% |

| Change from October (Raw Units): | -96 | -104 | -200 |

| Change from October (SA %): | -3.9% | -0.4% | -0.3% |

| Change from November of 2024 (%): | -15.7% | 18% | 2.9% |

| Change from November of 2024 (Units): | -72 | 102 | 30 |

THMA Member’s Retailer Monthly Sales Totals Report

Installation Location Trends

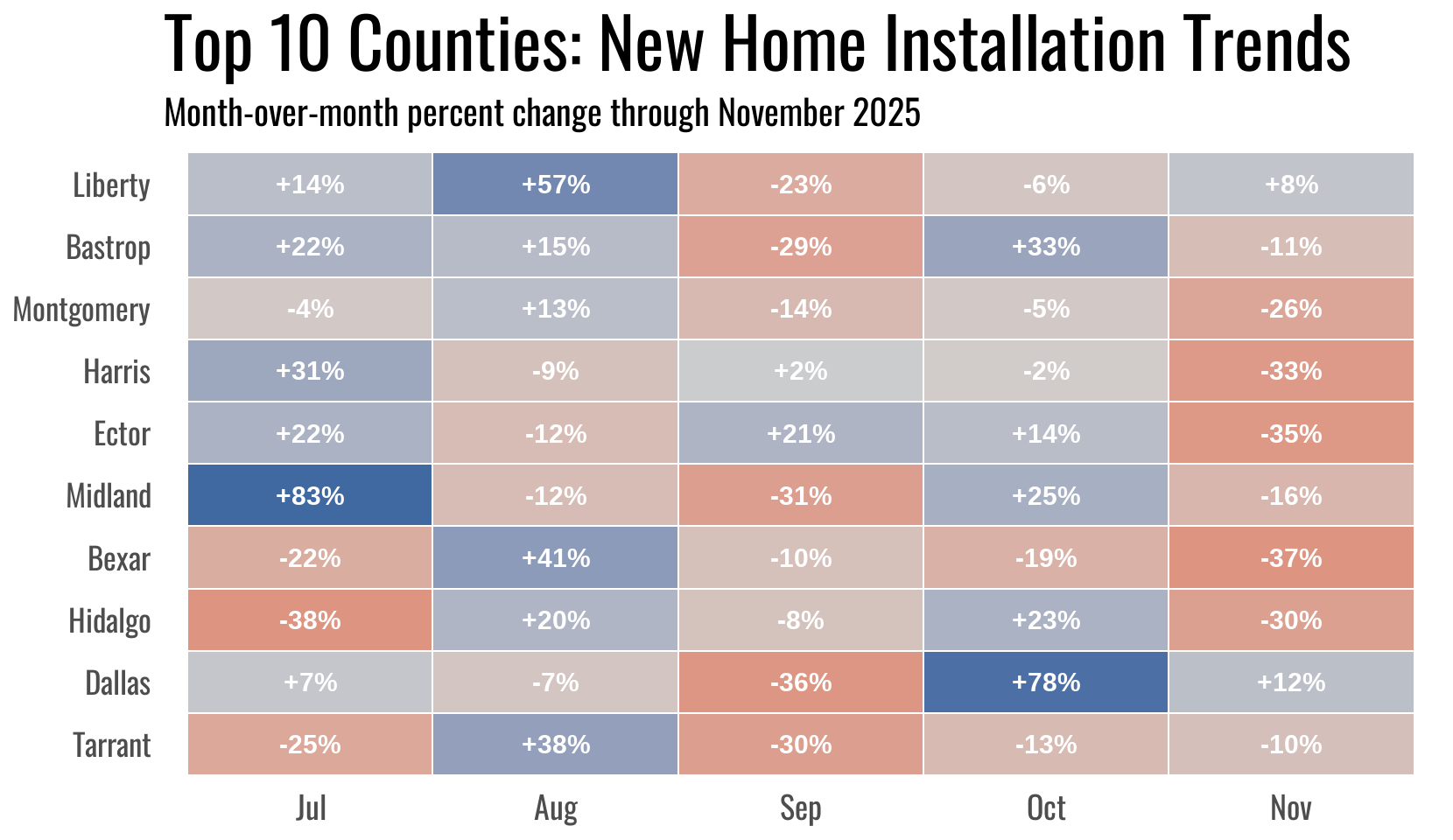

Here are the month-over-month changes for the top 10 counties for new home sales in November and in the previous four months.

Liberty and Dallas County new home placements came in up on the raw total despite the typical seasonal decline the rest of the top 10 counties displayed for November sales.

THMA Member’s Retailer Annual Sales Total per County Report

Annual Totals

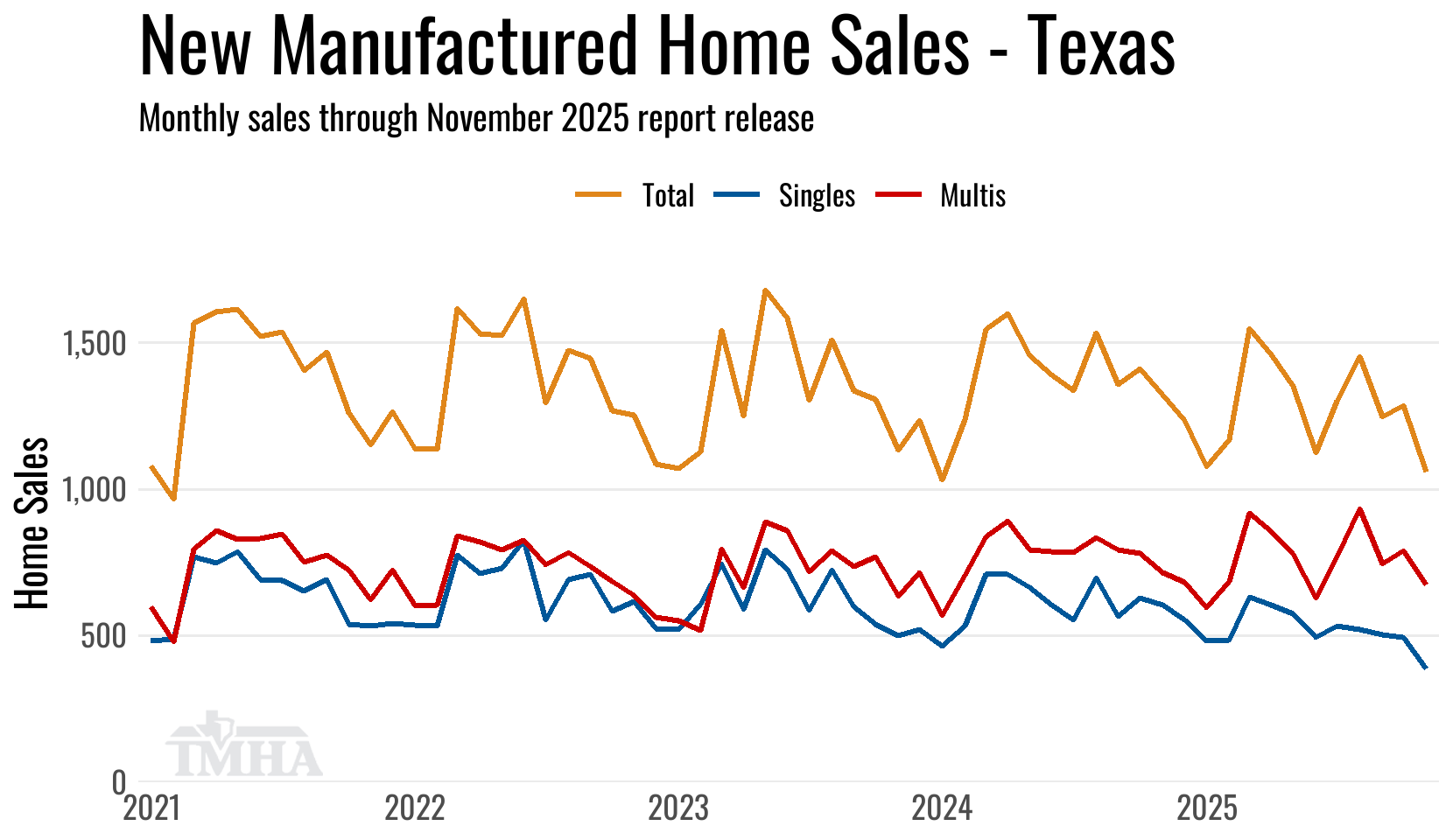

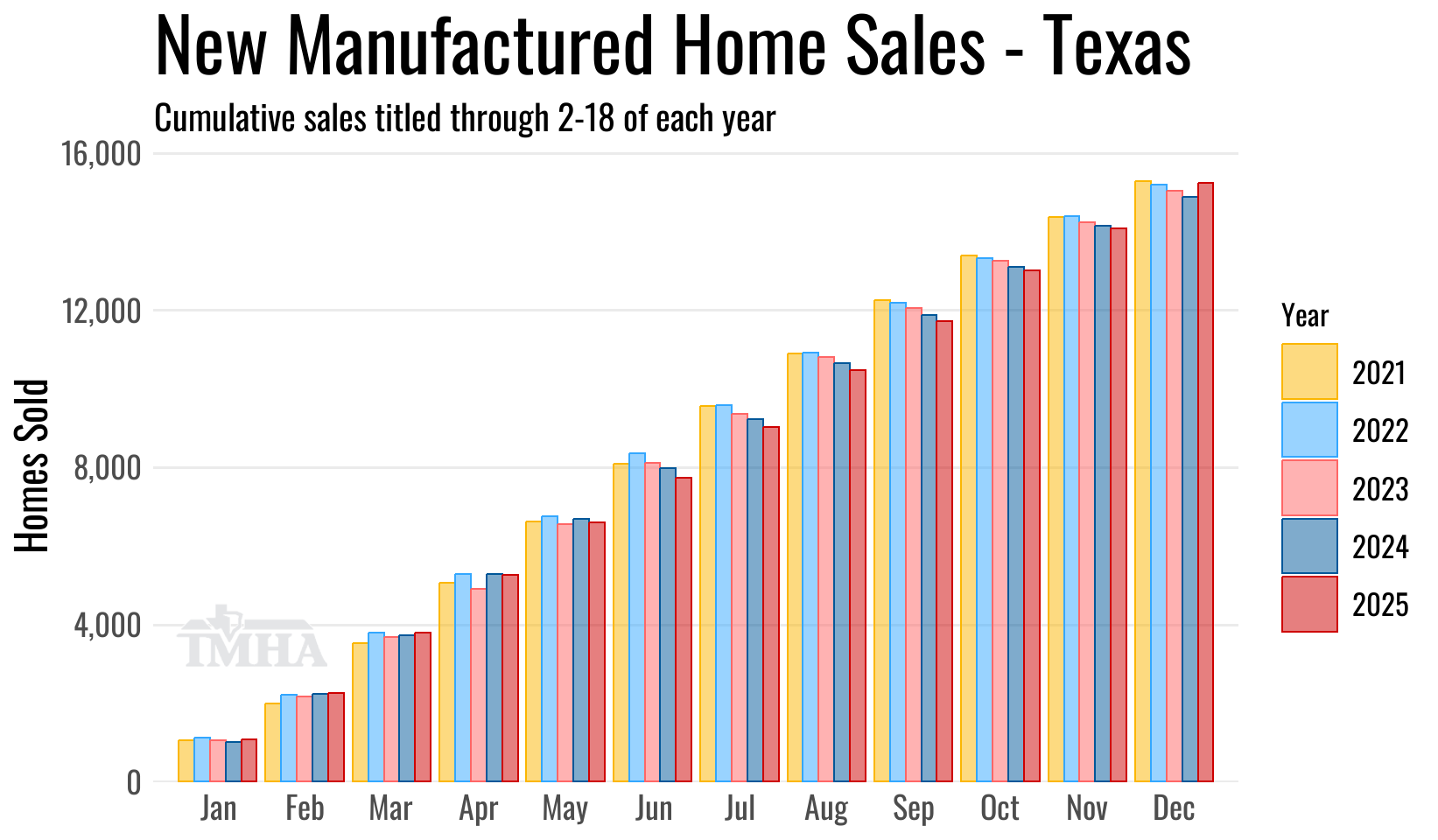

The year-over-year gain in new home sales for 2025 over 2024 continues to narrow and now sits at 2.3% for all retail sales titled through this point in the calendar.

Multi-section sales are currently up 8% while single-section sales are down 4.9%.

The increased speed in title work submission is pushing year-over-year sales up some, but the effects should not be as strong as seen in the individual month figures.

Now that we have moved into 2026 though, some of those sales are now getting pushed into the new year, so sales for 2024 will likely catch and exceed sales for 2025.

| New Sales | Singles | Multis | Total |

|---|---|---|---|

| Total for 2025 titled to date: | 6,186 | 9,042 | 15,228 |

| Change from 2024 (%): | -4.9% | 8% | 2.3% |

| Change from 2024 (Units): | -321 | 668 | 347 |

THMA Member’s Retailer Annual Sales Totals Report

New Home Characterstics

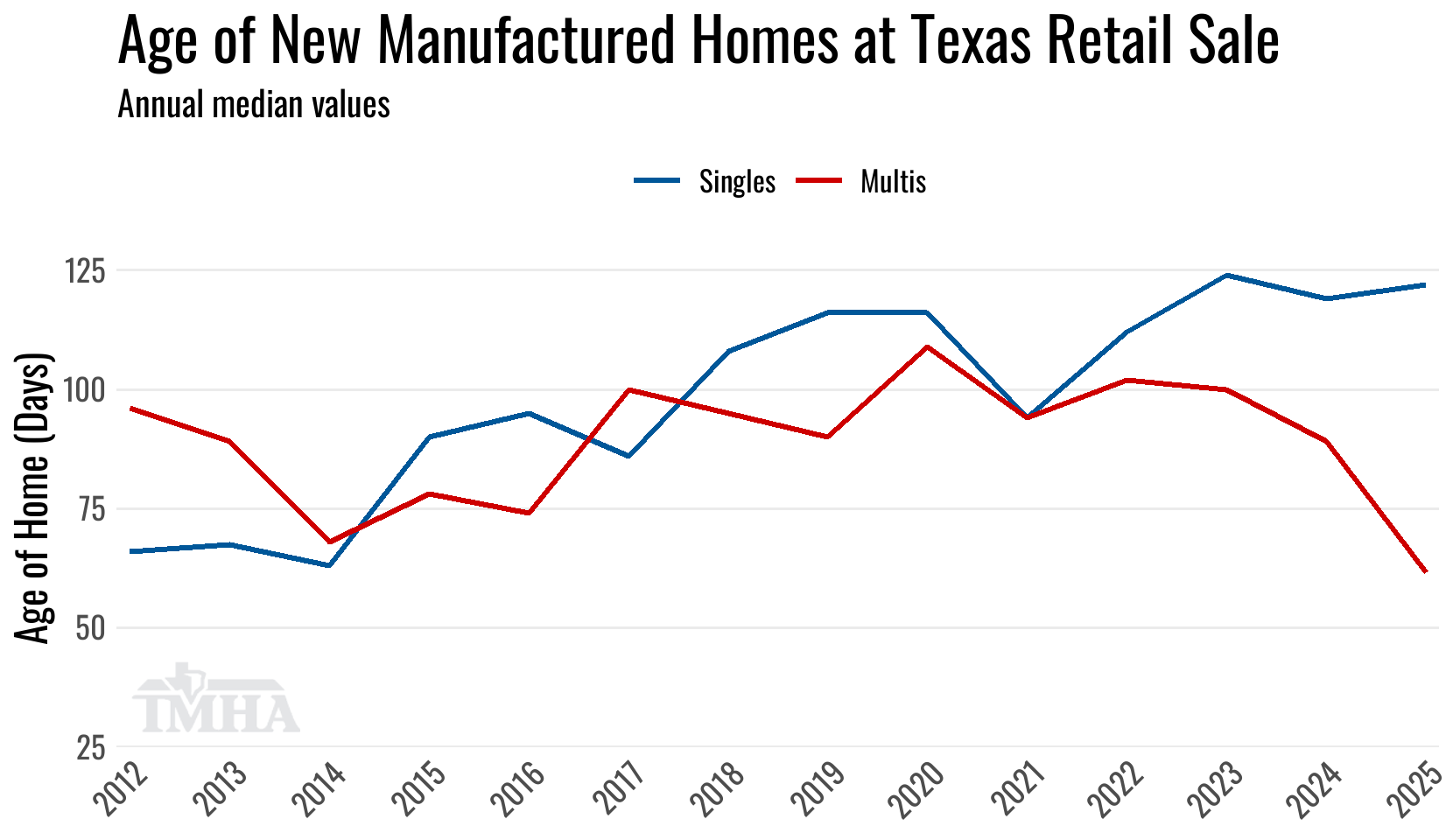

The shift in title cadence has really pulled down the median age of multi-section homes to the shortest amount of days in our records, but that same dynamic should apply to single-section homes too yet their median age remains near the 2023 peak.

| New Home Characteristics for 2025 | Singles | Multis | Total |

|---|---|---|---|

| Median Age of Home (Days): | 122 | 62 | 84 |

| Median Square Footage: | 1,080 | 1,680 | 1,475 |

New Home Placement Locations

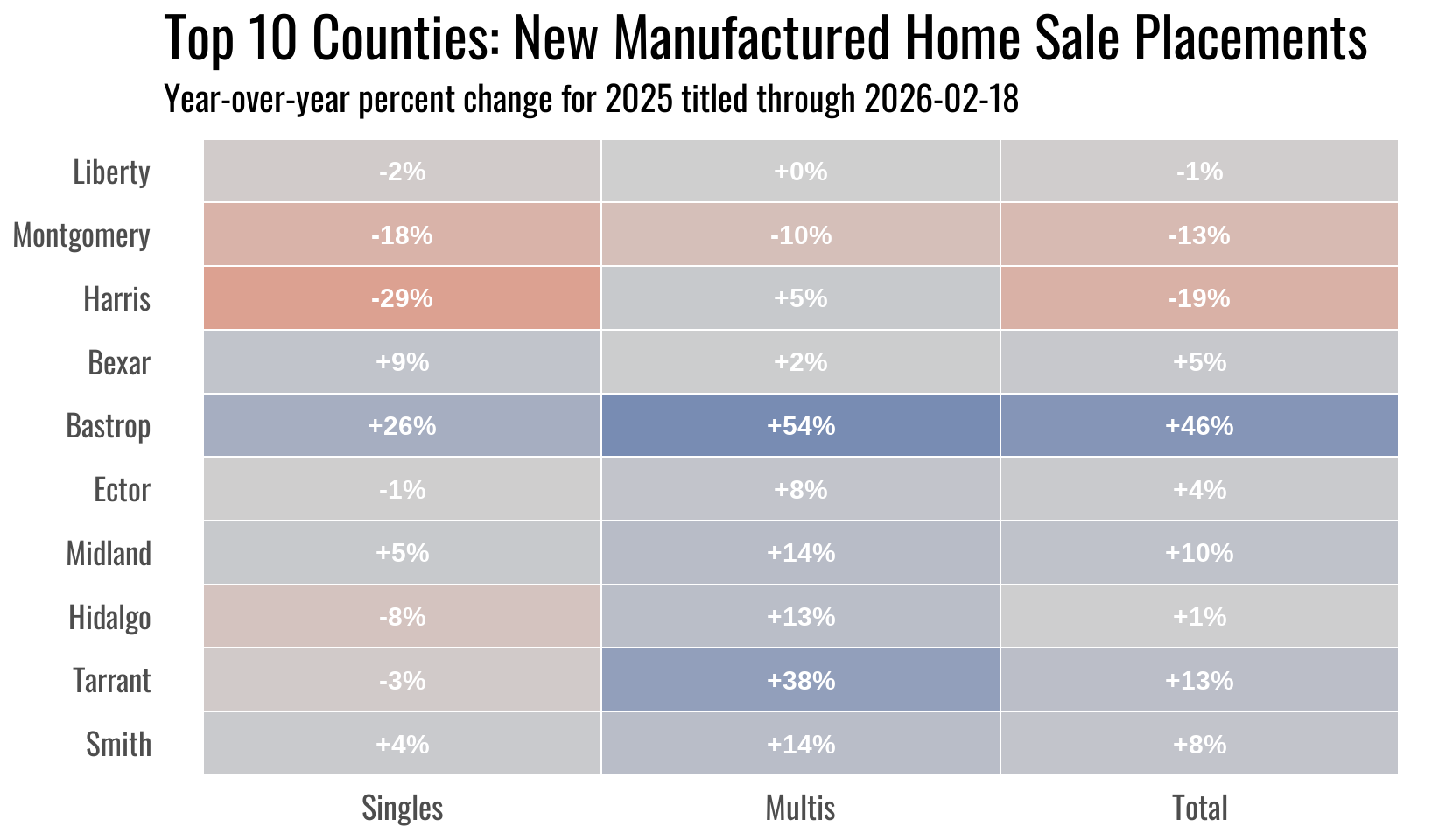

Here are the breakdowns in year-over-year changes for the top 10 counties in new home placements across home section types.

Bastrop sitting at number five on the list has seen much larger year-over-year growth in new home installations than the rest of the top 10 counties.

THMA Member’s Total Annual Retail Sales per County Report

Shipment Comparison

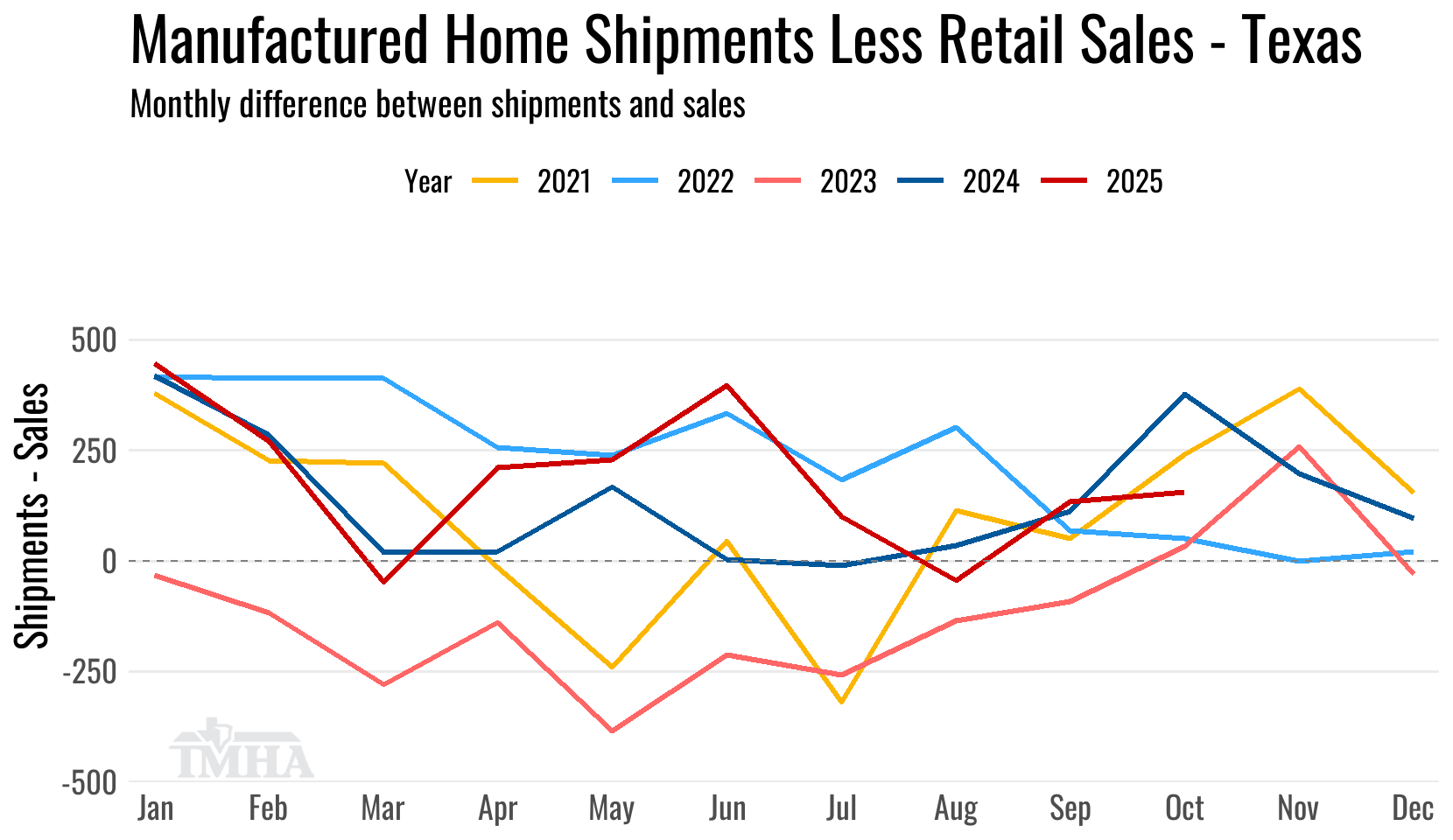

August marked the second time that retail sales outpaced shipments for a month in 2025. That usually occurs in July, but the shift in title cadence likely pushed what would have been reported July sales forward into August. The last third of the year is usually a period of aggregate inventory build up, so not having the typical drawdown in inventory that we usually see in July is putting downward pressure on shipments for the remainder of 2025 and into 2026.

Moving Averages

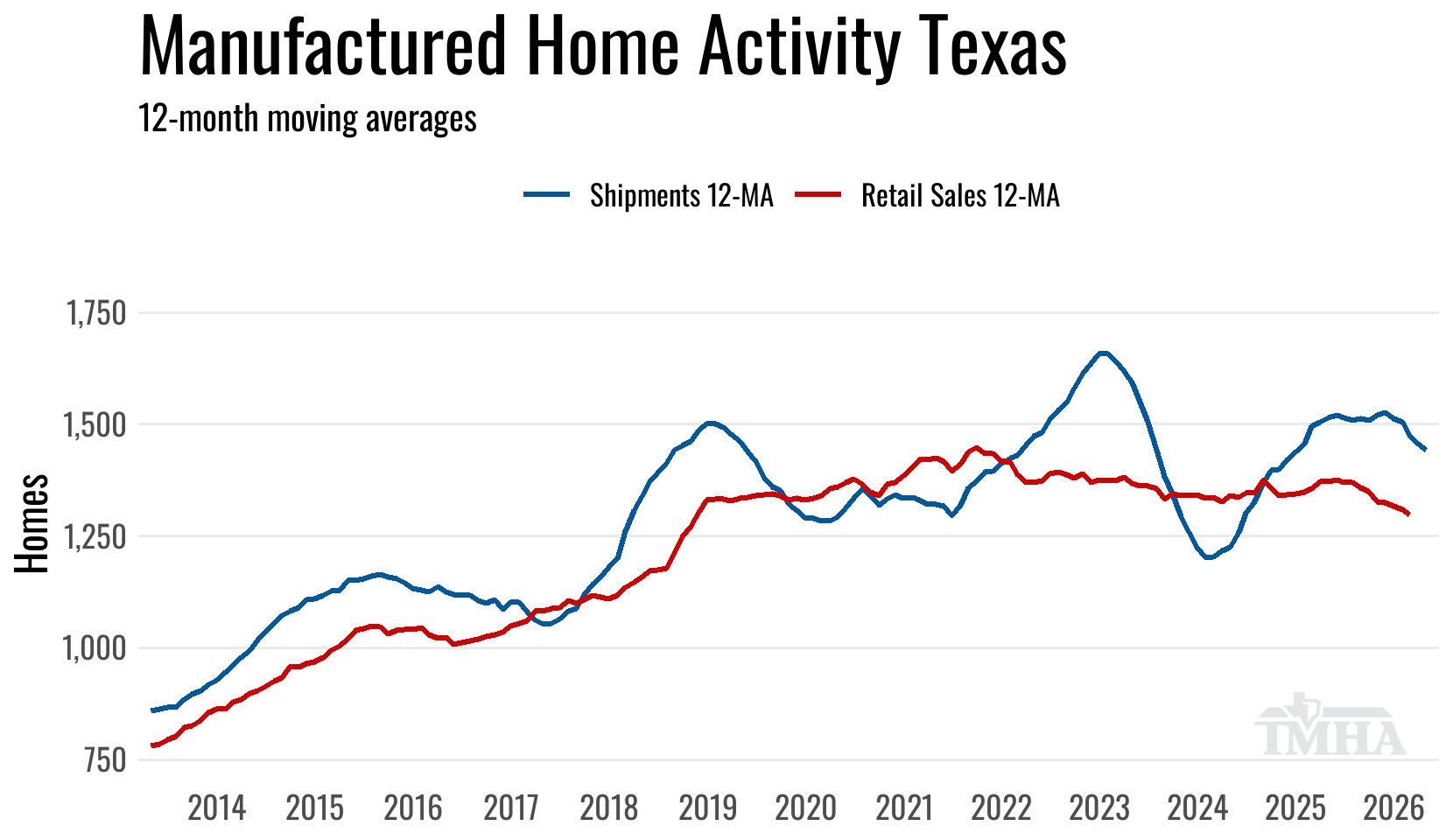

The 12-month moving average for shipments peaked in July of 2025 for this last production expansion cycle and has been moving lower through November.

The 12-month moving average for retail sales is currently plotted through October.

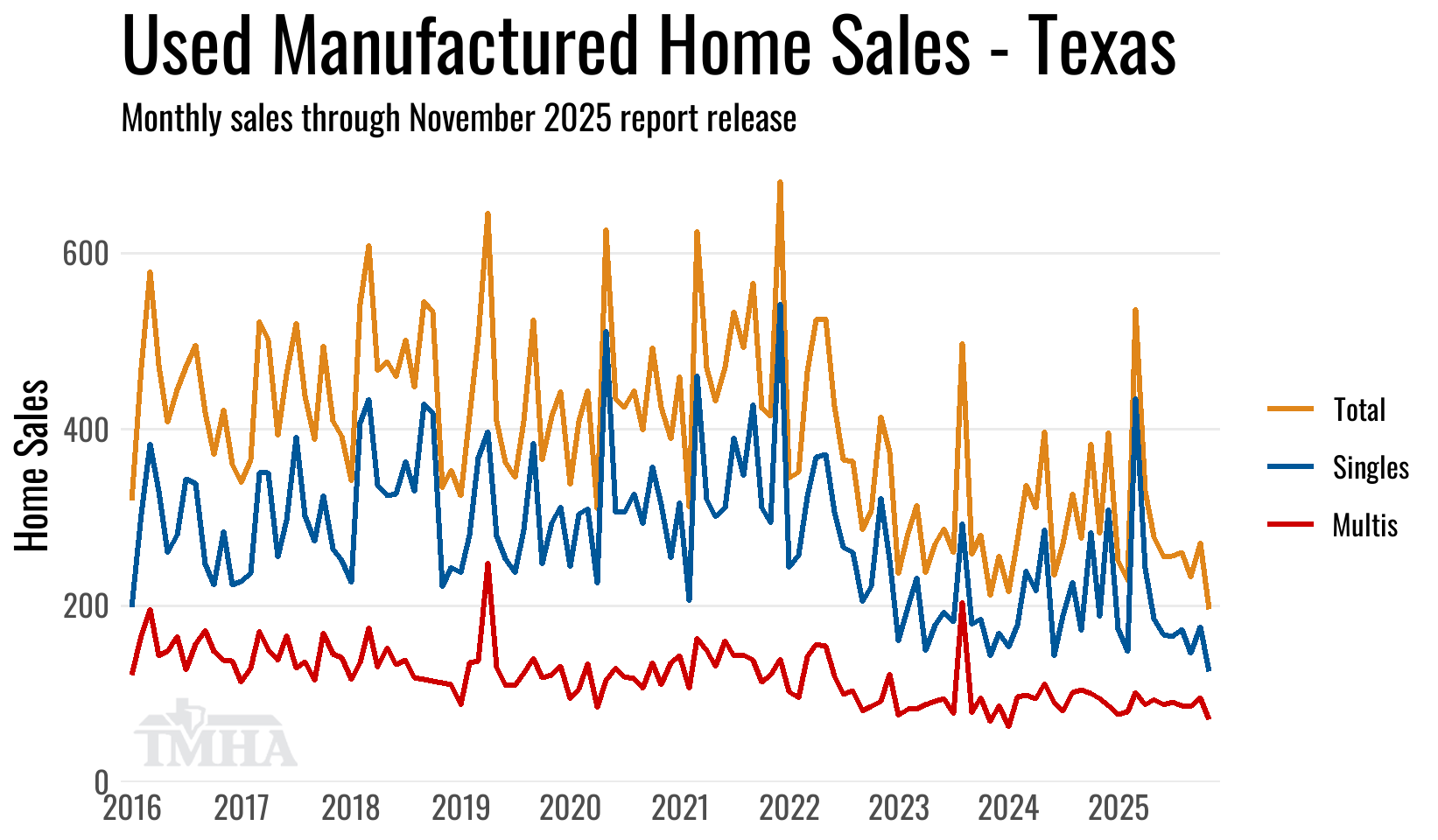

Used Homes

The used home retail sales data is noisy as it includes commercial purchases of park-owned homes after a manufacured home property is sold to a new buyer, but there was a clear downward trend in total transactions in the higher interest rate environment from 2022 through 2024 and sales have been moving sideways since.

| Used Sales | Singles | Multis | Total |

|---|---|---|---|

| Total for 2025 titled to date: | 2,277 | 1,034 | 3,311 |

| Change from 2024 (%): | 2.9% | 8.8% | 4.7% |

| Change from 2024 (Units): | 64 | 84 | 148 |

Revised Monthly Totals

Because titles continue to come in for past sales months, here are all prior months for the year and what their current sales totals are at this report release.

| New Sales Month | Singles | Multis | Total | (YoY%) |

|---|---|---|---|---|

| January | 483 | 594 | 1,077 | 6.8 |

| February | 486 | 684 | 1,170 | -3.6 |

| March | 630 | 917 | 1,547 | 3.5 |

| April | 605 | 854 | 1,459 | -6.3 |

| May | 574 | 777 | 1,351 | -3.8 |

| June | 494 | 629 | 1,123 | -13.7 |

| July | 532 | 768 | 1,300 | 3.6 |

| August | 520 | 932 | 1,452 | 2.8 |

| September | 502 | 745 | 1,247 | 2.3 |

| October | 494 | 790 | 1,284 | 3.9 |

| Used Sales Month | Singles | Multis | Total | (YoY%) |

|---|---|---|---|---|

| January | 174 | 77 | 251 | 24.9 |

| February | 148 | 80 | 228 | -13.6 |

| March | 435 | 101 | 536 | 71.2 |

| April | 242 | 88 | 330 | 17.4 |

| May | 185 | 93 | 278 | -11.7 |

| June | 167 | 88 | 255 | 20.9 |

| July | 165 | 91 | 256 | 4.9 |

| August | 173 | 87 | 260 | -1.5 |

| September | 146 | 86 | 232 | -5.3 |

| October | 176 | 95 | 271 | -17.4 |